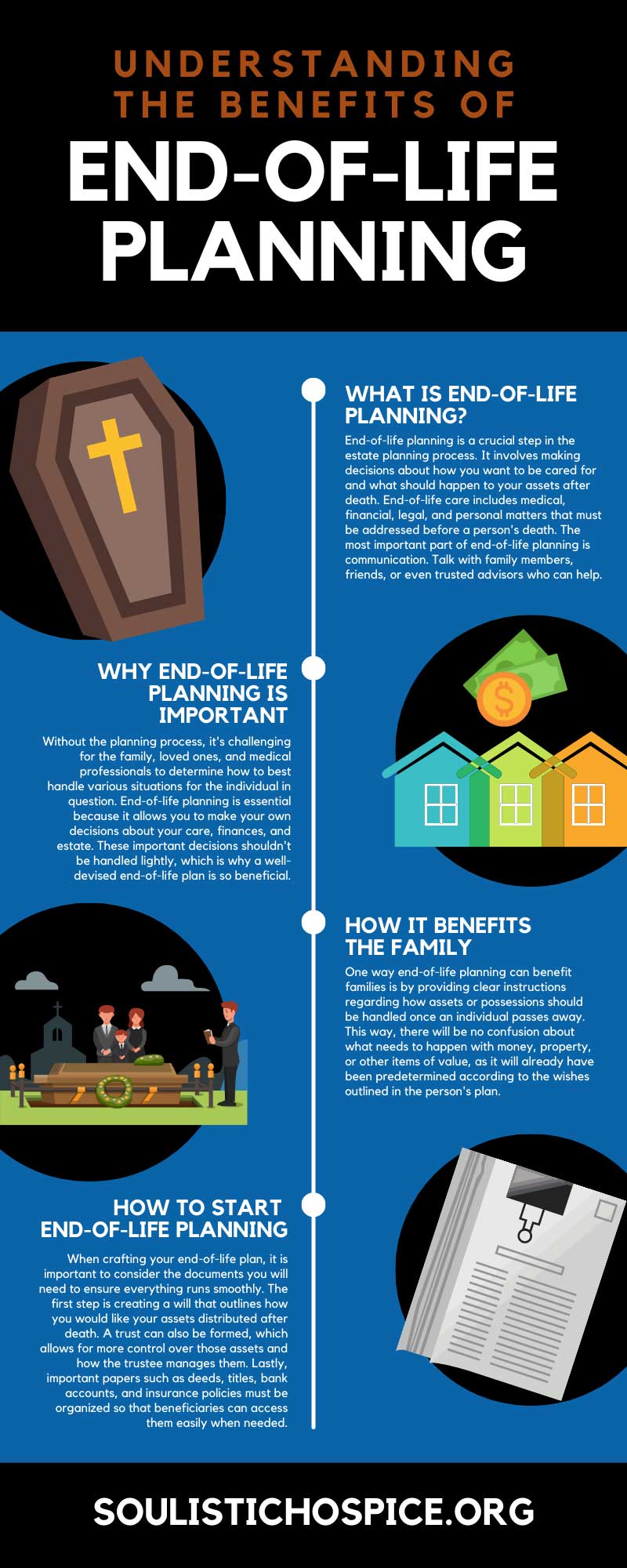

As we age, it's important to start thinking about end-of-life planning. While it might not be the most pleasant topic to discuss, it's necessary. When you reach a certain age or start to experience medical problems, it's essential to start planning appropriately. There are many different aspects to consider, including financial and medical considerations. And without a solid plan, it can be challenging to get your affairs in order when the time comes. Here is a comprehensive guide on understanding the benefits of end-of-life planning to help you get started.

What Is End-of-Life Planning?

End-of-life planning is a crucial step in the estate planning process. It involves making decisions about how you want to be cared for and what should happen to your assets after death. End-of-life care includes medical, financial, legal, and personal matters that must be addressed before a person's death. The most important part of end-of-life planning is communication. Talk with family members, friends, or even trusted advisors who can help. End-of-life planning discussions with family members or other caregivers are essential to ensure everyone involved has clarity about their roles during difficult times. Making these preparations now can provide comfort later on, knowing that everything has been taken care of according to one's wishes.

Why End-of-Life Planning Is Important

You might wonder why end-of-life planning is so important. If you've ever known someone who did not have an end-of-life plan in place before they passed, the answer behind the importance of this type of planning may be clearer. Without the planning process, it's challenging for the family, loved ones, and medical professionals to determine how to best handle various situations for the individual in question. End-of-life planning is essential because it allows you to make your own decisions about your care, finances, and estate. These important decisions shouldn't be handled lightly, which is why a well-devised end-of-life plan is so beneficial.

How It Benefits the Family

End-of-life planning is an important task that benefits not only the individual making these preparations but also their family members. Having a plan helps prepare those left behind after a loved one passes away and relieves the burden they may feel if they have to make certain decisions on their own. One way end-of-life planning can benefit families is by providing clear instructions regarding how assets or possessions should be handled once an individual passes away. This way, there will be no confusion about what needs to happen with money, property, or other items of value, as it will already have been predetermined according to the wishes outlined in the person's plan. In addition, having this information readily available can reduce stress levels for everyone involved since all decisions have already been made ahead of time. This leaves less guesswork up to those grieving the loss of a loved one.

How To Start End-of-Life Planning

While getting your affairs in order can be overwhelming, end-of-life planning helps relieve some of the stress. When you have a clear outline of everything you need to do, you can tackle tasks effectively. Continue reading to find out all the things you will need to do to start end-of-life planning.

Prepare Documents

When crafting your end-of-life plan, it is important to consider the documents you will need to ensure everything runs smoothly. The first step is creating a will that outlines how you would like your assets distributed after death. A trust can also be formed, which allows for more control over those assets and how the trustee manages them. Lastly, important papers such as deeds, titles, bank accounts, and insurance policies must be organized so that beneficiaries can access them easily when needed. Having these documents prepared before anything unexpected happens will help reduce stress later.

Decide Between a Will or Trust

When deciding between a will or trust, it is important to understand their differences. A will is a written document that dictates how someone's assets should be distributed after death. This document can also spell out specific instructions on who is appointed guardian of minor children and what funeral arrangements should occur. On the other hand, a trust is an arrangement created during life in which a person entrusts property to another party for safekeeping and management for beneficiaries upon their death. The primary benefit of setting up a trust over creating a will is that trusts are more difficult to challenge in court due to their private nature, while wills are public documents.

Finalize Healthcare Decisions

When it comes to healthcare decisions, choosing a power of attorney is one of the most important steps. A Power of Attorney (POA) is an individual or organization legally appointed to act on another's behalf in financial and legal matters. This person will be responsible for making healthcare-related decisions if you are unable to do so yourself. This person must be someone you trust completely and can discuss potential issues with openly and honestly before giving them this responsibility. Creating advance directives is also key in forming an effective end-of-life plan because it details wishes regarding medical treatment, including organ donation, living wills, and DNRs.

Plan Final Arrangements

Outlining final arrangements is another important part of any end-of-life plan. This process includes everything from deciding whether burial or cremation should take place and where the remains will be located down to details such as what type of service should be held and who will officiate it. It is also wise to consider prearranging services if possible. This process will ensure your wishes are carried out exactly as you would like once you pass away. It can provide peace of mind for you and your loved ones, knowing that everything has already been taken care of before death.

Now that you know how end-of-life planning can benefit you, you can start the process today. Soulistic Hospice offers an end-of-life care plan in Arizona that can help give you peace of mind and enables you to get your affairs in order. With the help of our dedicated professionals, you will be able to prepare for anything and can make the most of your time in hospice care. We provide resources for individuals and their families so that they can have guidance throughout the entire process.